Capital Allowances

Available to Sole Traders and Corporate Entities specifically in the Hospitality business and other businesses whereby it may be deemed that the Acquisition of Art through the business enhances the ambience of the property.

- Tax write down over 8 years at 12.5% per year

- Makes the premises more attractive to customers

- Creates or adds to ambience and atmosphere

Example

- Cost of Painting : €30,000

- VAT at 13.5% incl. : €3,568

- Net of VAT cost : €26,432

- Annual allowance for 8 years : €3,304

- Annual tax benefit at 52% : €1,718

- Total tax benefit at end of 8 year : €13,744

- Net cost of painting : €12,688

Capital Gains Tax (CGT)

-

Chattels Exemption

More on This Painting- Tangible, movable property

- Not chargeable to CGT if consideration does not exceed €2,540.

- Marginal relief

- Maximum CGT 50% of the difference between consideration and €2,540.

-

Disposal of Objects Loaned for Public Display

More on this Painting- CGT Exemption on the disposal of a qualifying object.

- Picture, print, book, manuscript, sculpture, piece of jewellery or work of art.

- Loaned for 10 years to an Irish heritage trust or to a gallery or museum approved by Revenue.

- Must be included in a display to which the public is afforded reasonable access.

- Market value of item must be at least €31,740 on date first loaned to gallery or museum.

Payment of Tax by Means of Donation of Heritage Items

- Donation to an approved body and the items for donation must be approved by a selection committee.

- Applies to heritage items including paintings.

- The export of the item from the State would constitute a diminution of the accumulated cultural heritage of Ireland.

- The item or collections of items must have a minimum value of €150,000 and if a collection at least one item must have a value of €50,000.

- The ceiling of the aggregate of items approved for donation in any one year is €6 million.

- Non refundable payment on account of tax set at 80% of the market value of the item donated.

Thank You!

Some available pieces:

-

Dún Briste Sea Stack, Downpatrick, Co Mayo

Regular price €2.500,00Regular priceUnit price per -

The Spirit of Brigid

Regular price €2.750,00Regular priceUnit price per -

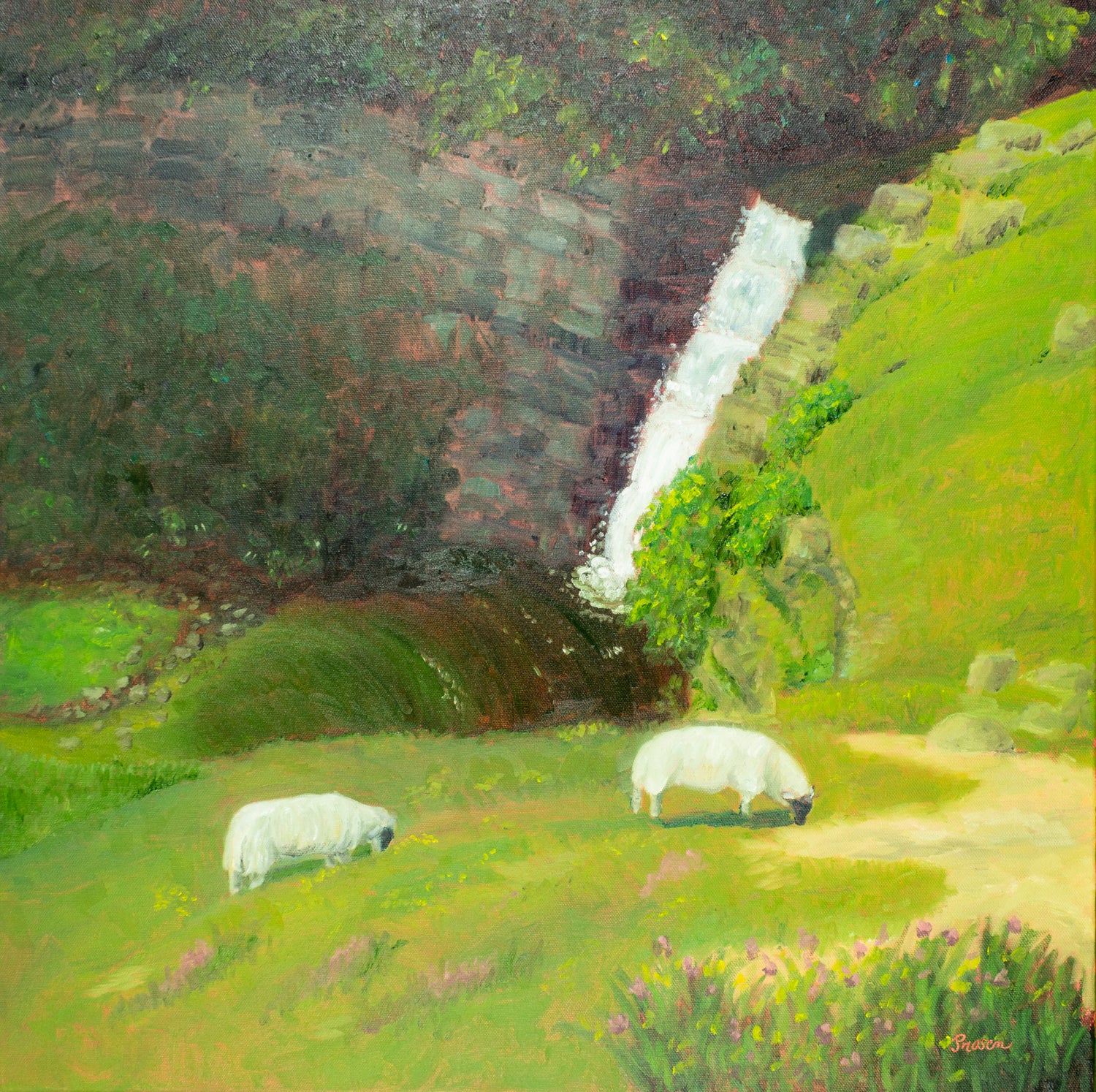

Highland Queen

Regular price €3.500,00Regular priceUnit price per -

Bathing in Alliums

Regular price €2.750,00Regular priceUnit price per